2512 EV Hardware Market

We track the charger OEM market

Today, we look at the Charger OEM market closely and make a sense of what is really happening in this space. We will identify leading players and interesting market shifts. This report is based on our data for public chargers collected as of December 2025.

This is the 4th edition PowerBI report. With the report, you can dig into trends and build your sales and competitive strategy. You can look at what has happened in the previous quarters and empower your sales team.

3rd edition (Sep 2025), 2nd edition (Jun 2025), 1st edition (Mar 2025).

For the last three weeks, we’ve published three reports - 10,000 ft overview on charging infrastructure and detailed insider’s view (part two) for our subscribers.

We hope that the industry will buy our reports to help us continue to run our business without being dependent on sponsorships and advertisements. This allows us to call a spade a spade. You can also support us by being a premium subscriber.

Annual premium subscribers to this blog will be able to request a 24h access to this PowerBI instantly. Monthly subscribers can request for any chart of their choosing from the report. More details here.

Become a paying subscriber today!

House Keeping

We will be in Gandhinagar later this month to attend this event. We will be doing B2B meetings along the sidelines. Drop us a message if you are around!

Index

Acknowledgement

Incredible thanks to Garvit and our data tagging team to come up with the report and our PowerBI application. We would also like to thank the CPOs who took initiative to help clear our doubts. Our objective is to present the information as accurately as possible.

Disclaimer

All rights reserved with Priyans Murarka @ ExpWithEVs.

The data from here and this article cannot be repackaged or sold without explicit written permission of ExpWithEVs.

Major Caveats

All chargers in this report are public only.

An OEM is identified as a charger manufacturer, white label importer or assembler. We have no distinct way to identify who is what. We have a hunch, but we don’t say it publicly.

We do not include chargers from BPCL, HPCL and IOCL in our report.

Few reasons for exclusion :

Most of their chargers are offline.

All charger installations are done via public tenders, making it public information.

Very few photos of these chargers exist online, making it harder for us to cross verify.

How to get access

Reach out to me via LinkedIn or Email.

Summary

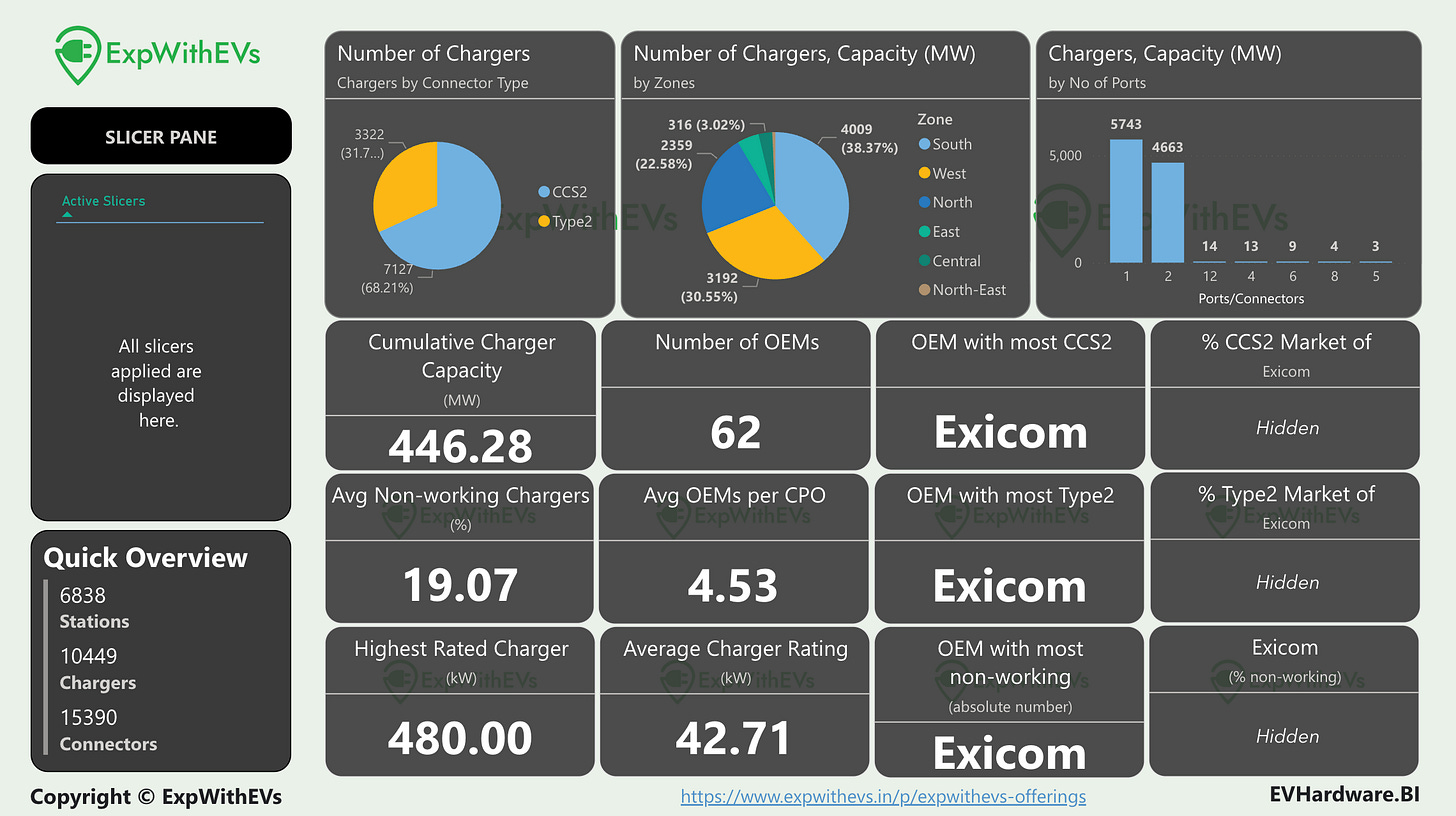

Single connector chargers are the most common, with dual connectors in the second rank. Note, this includes both CCS2 and Type2 chargers.

We will discuss the market share numbers and non working ratios in the following sections.

On an average, a CPO has 4 to 5 charger OEMs in their network.

OEM Market Share

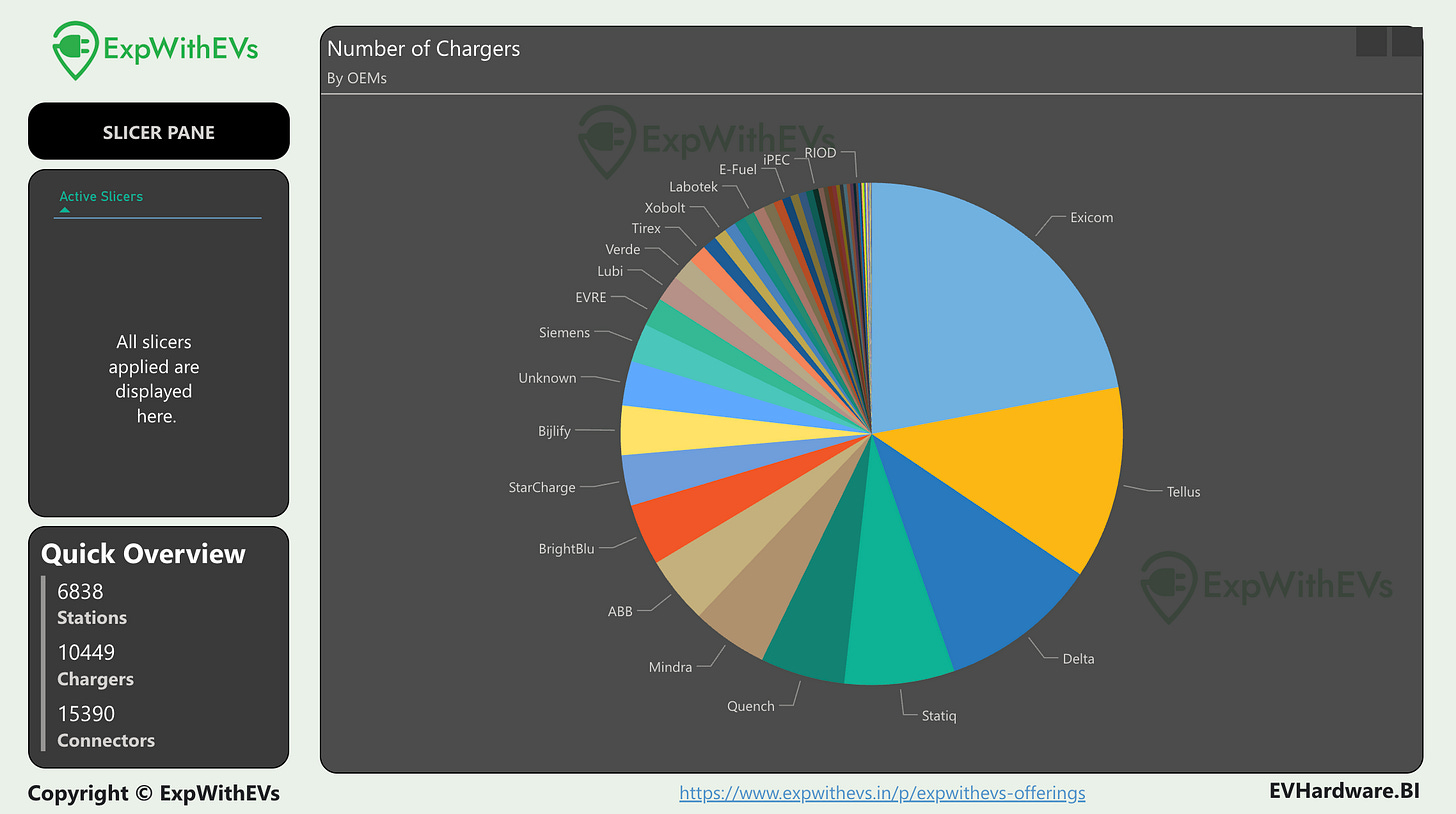

Exicom leads with over 20% marketshare for all public CCS2 and Type2 chargers, PSUs not included. Some OEMs have gained marketshare whereas some were able to hold on to it. Some OEMs even lost marketshare.

A loss in marketshare can happen due to addition of fewer chargers or net removal of chargers. Among the top players, Exicom, Delta and Tellus lost their marketshare. For Exicom and Delta, it is due to the former, where they increased their network by less than 5%. Tellus chargers were removed on a net basis, leading to a drop.

Tellus and Delta’s marketshare fell in the previous quarter too, indicating an incoming decline for these companies. Exicom had gained market share in the previous report, but it ended up on the losing side this time.

Statiq, Quench and Mindra increased their marketshare this quarter. Among the top players, Mindra jumped the maximum and is now ranked 6th among major OEMs. We strongly believe they will continue their growth and can leapfrog Quench.

There’s enough delta between Quench and Statiq and Statiq and Delta. So we might not see any immediate movement in rankings for the top four.

BrightBlu is the only player in the cumulative top ten OEMs to manufacture only Type2 chargers. Rest manufacture both. Let us look at these markets individually.